Turkey’s emerging market status may face downgrade

- Date: 26-Jun-2020

- Source: Arab News

- Sector:Financial Markets

- Country:Qatar

Turkey’s emerging market status may face downgrade

Turkey's emerging market status may face downgrade

ANKARA: Turkey's main share index may be downgraded by a top international index compiler in what would be a blow to its already volatile financial markets.

MSCI, a prominent index provider, said it may lower the status of Turkey's share index to a "frontier market“ due to bans on short selling and stock lending since October 2019 and February 2020, respectively. That would mean the loss of major investment by international pension funds and other instituional investors that use MSCI indexes to deploy their capital. Frontier markets are seen to carry more investor risk.

"In the last 12 months, two important emerging markets, Argentina and Turkey, suffered substantial deterioration in market accessibility that could lead to their exclusion from the MSCI Emerging Markets Index,“ said Dimitris Melas, global head of equity research and chairman of the MSCI Index Policy Committee.

Experts think that this new warning should be taken as a sign of the unease of foreign investment in the country as the government adopts ever stricter measures on the currency exchange.

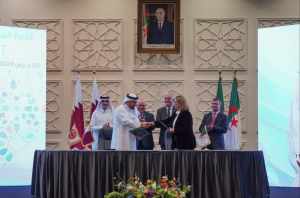

Qatar's recent move to increase its currency swap line with Turkey may have provided some relief, but analysts still see the potential need for further