Bahrain Family Leisure Company signs MOU with Dividend Gate Capital Hospitality for potential M&A deal

- Date: 23-Feb-2023

- Source: Zawya

- Sector:Financial Markets

- Country:Bahrain

Bahrain Family Leisure Company signs MOU with Dividend Gate Capital Hospitality for potential M&A deal

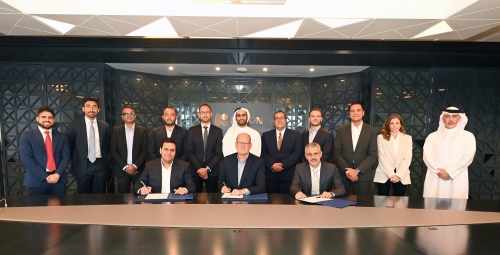

Bahrain Family Leisure Company B.S.C (BFLC) and DGC Hospitality & Partners, the food and beverage investment arm of Dividend Gate Capital (DGC) have signed an MOU in October 2022 for a potential M&A transaction between the two companies. SICO BSC (c), a leading regional asset manager, broker, market maker and investment bank (licensed as a wholesale bank by the CBB), has been appointed as advisor to BFLC on the M&A deal. Grant Thornton has been appointed as the advisor to DGC Hospitality.

The two leading players in Bahrain’s food & beverage (F&B) and hospitality sector have signed an MOU to explore the possibility of a potential consolidation between the companies, which would result in a powerful market player with improved efficiencies and an increased market share. The MOU outlines the intent of the parties to negotiate and finalize the terms and conditions of the deal, which is in line with the region’s initiatives to expand the tourism sector as part of overall economic growth plans. The F&B and hospitality industries already play a significant role in Bahrain’s economy and are on track for future growth.

Commenting on the future potential of the deal, Abdul Latif K. Al-Aujan, BFLC Chairman, said, “Bringing together