MSX’s initiative to inject liquidity in the market

- Date: 13-Jan-2024

- Source: Times of Oman

- Sector:Financial Markets

- Country:Oman

MSX’s initiative to inject liquidity in the market

Muscat: Muscat Stock Exchange (MSX), in cooperation with the National Financial Sustainability Programme, launched a new initiative to inject liquidity in the market.

The initiative consists of providing liquidity in the market and ensure a balance between buying and selling shares and helping in reducing and limiting unmatched selling offers.

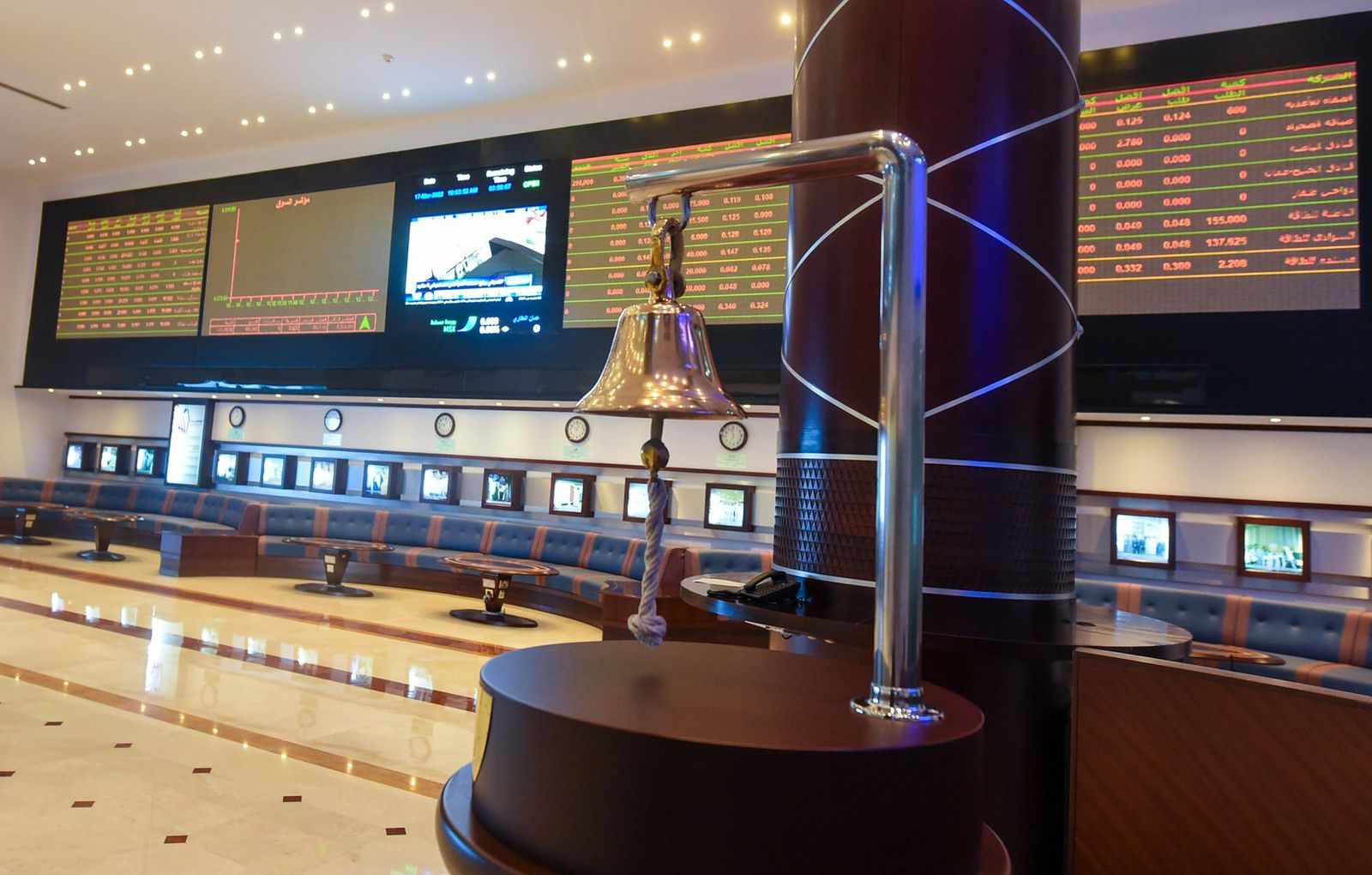

The MSX, under the patronage of Abdullah bin Salem Al Salmi, CEO of the Capital Market Authority (CMA), will celebrate on Sunday by ringing the opening bell of the Liquidity Provider Service.

Oman Telecommunications Company has appointed United Securities Company as the liquidity service provider for Omantel shares, while Sohar International Bank has appointed Ubar Capital as the liquidity service provider for the bank’s shares listed on the Muscat Stock Exchange.

Mustafa Ahmed Salman, Chairman of the Board of Directors of United Securities Company, elaborating on the initiative, said that a liquidity provider is essentially an intermediary that trades large amounts of stocks to ensure that market participants can continually buy and sell assets as and when they wish. Liquidity providers will perform important functions in the market to help in stabilising prices, reduce volatility and make trading more cost-effective.

In a statement to the Oman News Agency, he said that all these factors will