Saudi’s PIF gives initial price guidance for three-part bonds- document

- Date: 22-Jan-2024

- Source: Zawya

- Sector:Financial Markets

- Country:Saudi Arabia

Saudi’s PIF gives initial price guidance for three-part bonds- document

Saudi Arabia's sovereign wealth fund, the Public Investment Fund (PIF), has given initial price guidance for its benchmark-sized, dollar-denominated triple-tranche bonds, a bank document showed on Monday.

The Saudi wealth fund has given initial guidance of around 150 basis points over U.S. Treasuries for its 5-year bonds, 175 bps over UST for its 10-year bonds and 235 bps over the same benchmark for its 30-year option, the document showed.

Citi, Goldman Sachs International and J.P. Morgan are working as joint global coordinators for bond offering, according to the document.

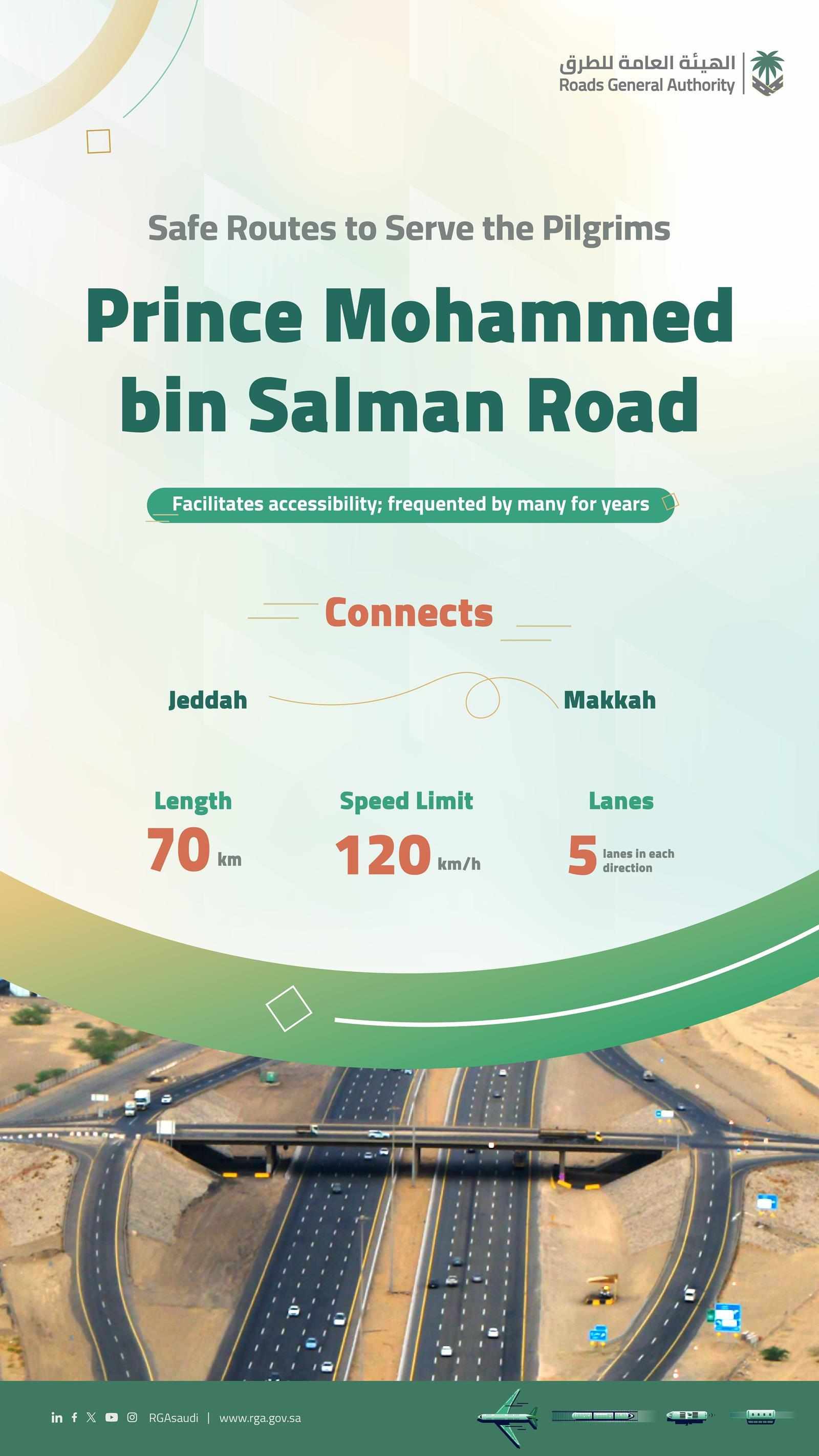

PIF is the chosen vehicle of Saudi Crown Prince Mohammed bin Salman, Saudi Arabia's de facto ruler, to drive the country's ambitious plan to wean itself off oil as it spends billions on diversifying its economy.

Last October, PIF completed the issuance of Islamic bonds for $3.5 billion that drew strong demand, in the first major test for Middle Eastern markets since the latest Israel-Hamas conflicts.

Debt issuance from emerging markets has made a roaring start in 2024 with bond sales in the first half of January topping $30 billion. ($1 = 3.7505 riyals)

(Reporting by Shamsuddin Mohd and Federico Maccioni; Additional reporting by Karin Strohecker, editing by Jason Neely and Ed Osmond)

Disclaimer: The content of this