UAE stock markets can ride GDP gains for a solid showing in 2023

- Date: 22-Jan-2023

- Source: Gulf News

- Sector:Financial Markets

- Country:UAE

UAE stock markets can ride GDP gains for a solid showing in 2023

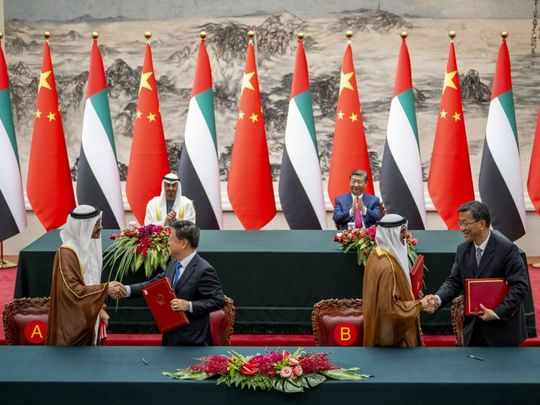

After ending 2022 on a high, UAE stocks are poised for a sturdy performance in 2023. Economic activity in the UAE is set to surpass historical trends, buoyed by a pipeline of infrastructure projects, new stock market listings, further recovery in tourism, elevated oil prices, and growing hydrocarbon output. The IMF forecasts non-hydrocarbon GDP growth of 4 per cent in 2023, while the World Bank forecasts UAE to grow by 4.1 per cent. As such, the UAE is expected to outperform most global economies and be the fastest-growing GCC nation. Reopening of the Chinese economy has bolstered the demand outlook for fuel, lending support to oil prices. Right after lockdown restrictions were lifted, Chinese outbound travel bookings surged 250 per cent while visa applications for international travel rose 12x year-on-year. The UAE will undoubtedly benefit from such pent-up travel demand. UAE’s real estate sector is defying the global trend of diminishing liquidity and deteriorating market confidence arising from macro-economic headwinds. Stable economic conditions, business reforms, and government initiatives like the Golden Visa are attracting foreign real estate investors to the UAE. The return of Chinese investors is a substantial tailwind. Demand for industrial and logistics space remains high while supply