StanChart upgrades forecast, unveils $1bln buyback after profit jumps 28%

- Date: 16-Feb-2023

- Source: Zawya

- Sector:Financial Services

- Country:UAE

StanChart upgrades forecast, unveils $1bln buyback after profit jumps 28%

SINGAPORE/LONDON: Standard Chartered raised a key performance metric and announced a new $1 billion share buyback on Thursday after posting a 28% rise in annual pretax profit as global interest rate hikes boosted its lending revenue.

The Asia, Africa and Middle East-focused bank reported statutory pretax profit of $4.3 billion for 2022. That came below the $4.73 billion average of analyst forecasts compiled by the bank but beat the $3.35 billion it made in 2021.

StanChart announced a new $1 billion share buyback that would start imminently.

The London-headquartered bank upgraded its performance forecast, saying it now expected to achieve a return on tangible equity - a key profitability metric - of 10% this year and 11% in 2024. It had previously targeted 10% for 2024.

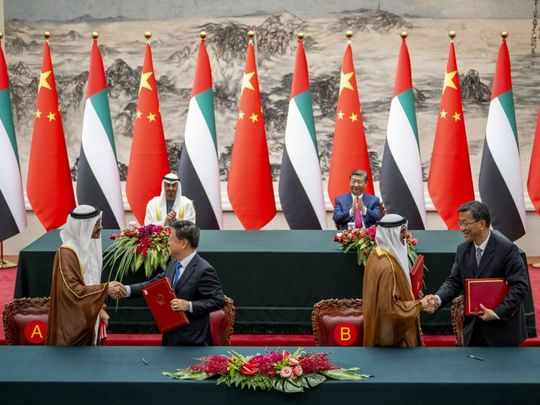

StanChart reported earnings following a burst of renewed takeover speculation after First Abu Dhabi Bank PJSC rejected media reports that it was currently eyeing a bid for StanChart.

The United Arab Emirates' biggest lender last week said it was not currently evaluating an offer for the bank, having previously acknowledged it had at one time worked on a potential bid.

StanChart took a higher-than-expected $838 million credit impairment for rising bad loans, as accelerating inflation and slowing economies in major