TDF enters into tripartite partnership to develop hospitality projects in the Kingdom

- Date: 30-Nov-2022

- Source: Saudi Gazette

- Sector:Healthcare

- Country:Saudi Arabia

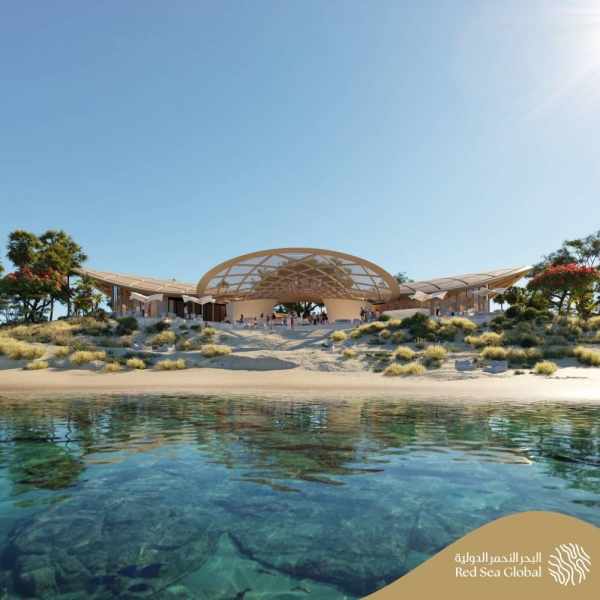

TDF enters into tripartite partnership to develop hospitality projects in the Kingdom

RIYADH — The Tourism Development Fund (TDF) which entered into a tripartite partnership with Ennismore, the fastest-growing lifestyle hospitality company in the world, and Al Rajhi Capital, one of the leading Asset Managers in Saudi Arabia, has identified multiple sites to develop exciting lifestyle developments across the Kingdom, including urban beachfront sites. The projects to be developed are part of the newly formed Lifestyle Hospitality Fund, which has recently received approval by the Saudi market regulator, Capital Market Authority (CMA). The fund aims at advancing Ennismore’s lifestyle hotels in the Kingdom with a targeted fund size of $400 million (SR1.5 billion). In 2021, during the Future Investment Initiative in Riyadh, TDF and Ennismore signed an MoU to commence discussions for launching an investment fund. This was followed by TDF, Ennismore, and Al Rajhi Capital signing a tripartite agreement in July this year to establish the now approved lifestyle hospitality fund. Furthermore, MOUs were signed with selected investors who expressed interest in coming into the fund with their respective assets. TDF will be the anchor investor in the newly established investment fund, while Ennismore will lead on the operation of these assets post completion under the umbrella of its lifestyle brands.