Oil steady as investors weigh tighter supply vs. growth outlook

- Date: 10-Apr-2023

- Source: Zawya

- Sector:Oil & Gas

- Country:Saudi Arabia

Oil steady as investors weigh tighter supply vs. growth outlook

SINGAPORE: Oil prices were roughly unchanged on Monday as investors weighed the prospect of tighter supplies from OPEC+ producers from May against concerns about weakening global growth that may dampen fuel demand.

Brent crude futures slipped 5 cents to $85.07 a barrel by 0237 GMT, while U.S. West Texas Intermediate crude was at $80.72 a barrel, up 2 cents.

Both contracts rose for a third straight week last week, returning to levels last seen in November, after the Organization of the Petroleum Exporting Countries and their allies surprised investors by announcing more production cuts that will start in May.

The group known as OPEC+ will be cutting mostly sour crude supplies from Middle East producers led by Saudi Arabia.

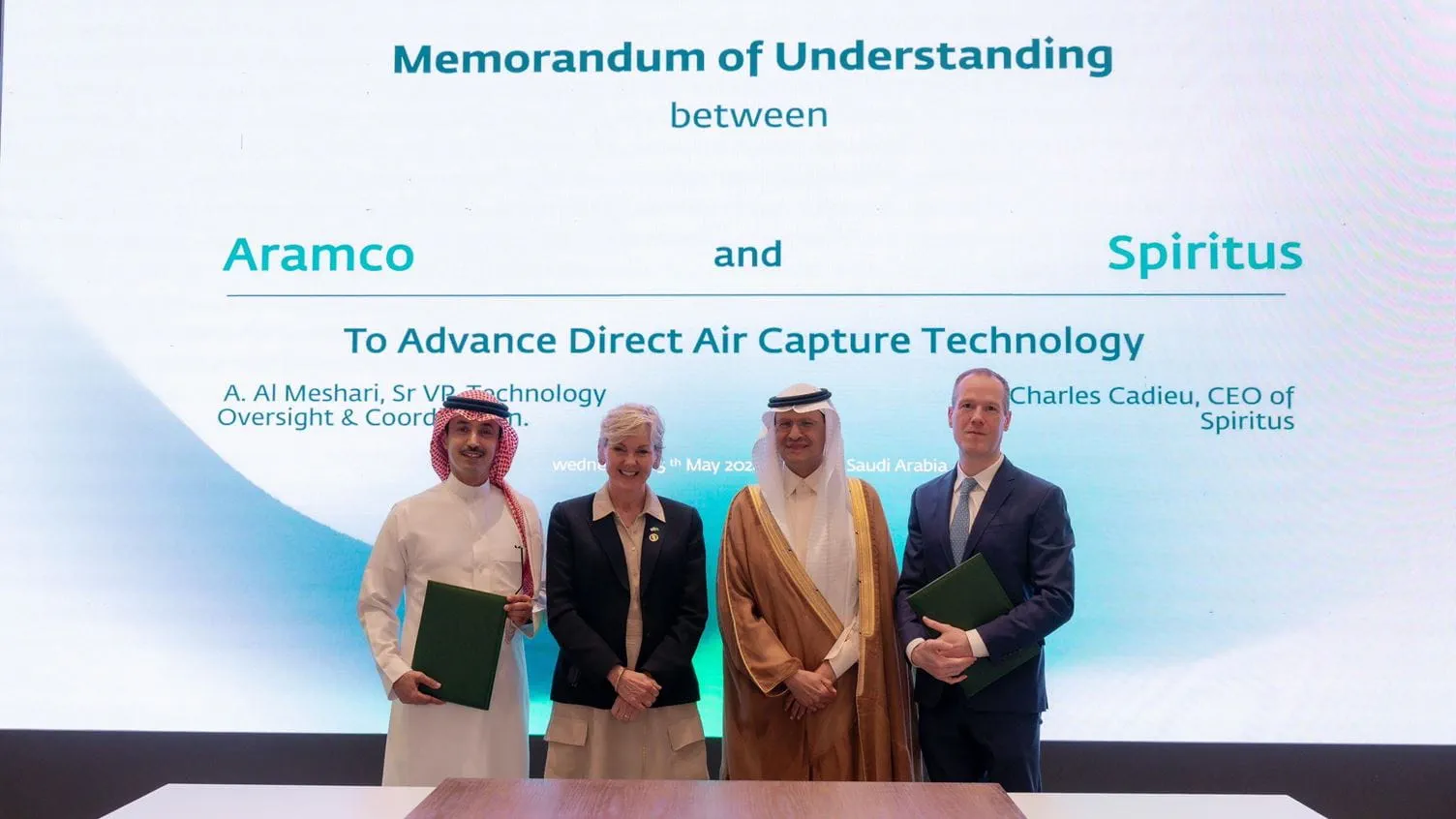

Following the announcement, the world's top oil exporter raised its May crude prices to term customers in Asia and the United States. State oil giant Saudi Aramco has also notified several Asian customers that they will receive full contract volumes in May despite the production cut.

"Those who were bearish are questioning the demand outlook in light of the cuts, whilst clearly those who were bullish are now seeing even a tighter market over the second half," ING's head of commodities research Warren Patterson said.

"I am